Cameron Ambrosy spent the primary weekend of December going to 10 open homes — purely for analysis functions. The 25-year-old in St. Paul, Minn., has a well-paying job and she or he and her husband are saving diligently, however she is aware of that will probably be years earlier than they will afford to purchase.

“It’s far more of a long-term objective than for my dad and mom or my grandparents, and even my friends who’re barely older,” mentioned Ms. Ambrosy, including that for a lot of of her buddies, homeownership is even farther away. “There’s lots of nihilism round long-term targets like house shopping for.”

As many individuals pay extra for hire and a few battle to avoid wasting for starter houses, political and financial analysts are warning that housing affordability could also be including to financial unhappiness — and is prone to be a extra salient problem within the 2024 presidential election than in years previous.

Many Individuals view the financial system negatively although unemployment is low and wage progress has been sturdy. Youthful voters cite housing as a selected supply of concern: Amongst respondents 18 to 34 in a current Morning Seek the advice of survey, it positioned second solely to inflation total.

Cautious of the problem and its political implications, President Biden has directed his financial aides to give you new and expanded efforts for the federal authorities to assist Individuals who’re scuffling with the prices of shopping for or renting a house, aides say. The administration is utilizing federal grants to prod native authorities to loosen zoning rules, as an example, and is contemplating government actions that target affordability. The White Home has additionally dispatched high officers, together with Lael Brainard, who leads the Nationwide Financial Council, to give speeches in regards to the administration’s efforts to assist individuals afford houses.

“The president could be very targeted on the affordability of housing as a result of it’s the single most essential month-to-month expense for thus many households,” Ms. Brainard mentioned in an interview.

Housing has not historically been an enormous issue motivating voters, partly as a result of key market drivers like zoning insurance policies are usually native. However some political strategists and economists say the fast run-up in costs for the reason that pandemic may change that.

Rents have climbed about 22 percent since late 2019, and a key index of home prices is up by an excellent heftier 46 p.c. Mortgages now hover round 7 p.c because the Federal Reserve has raised charges to the very best degree in 22 years in a bid to include inflation. These elements have mixed to make each month-to-month hire and the dream of first-time homeownership more and more unattainable for a lot of younger households.

“That is the singular financial problem of our time, they usually want to determine find out how to speak about that with voters in a means that resonates,” mentioned Tara Raghuveer, director of KC Tenants, a tenant union in Kansas Metropolis, Mo., referring to the White Home.

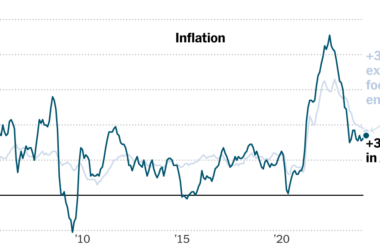

The housing affordability crush comes at a time when many customers are dealing with larger costs typically. A bout of fast inflation that began in 2021 has left households paying extra for on a regular basis requirements like milk, bread, fuel and plenty of providers. Regardless that prices are now not rising so rapidly, these larger costs proceed to weigh on shopper sentiment, eroding Mr. Biden’s approval scores.

Whereas incomes have just lately stored up with value will increase, that inflationary interval has left many younger households devoting an even bigger chunk of their budgets to rental prices. That’s making it harder for a lot of to avoid wasting towards now-heftier down funds. The scenario has spurred a bout of viral social media content material in regards to the problem of shopping for a house, which has lengthy been a steppingstone into the center class and a key part of wealth-building in the US.

That’s why some analysts suppose that housing issues may morph into an essential political problem, notably for hard-hit demographics like youthful individuals. Whereas about two-thirds of American adults total are householders, that share drops to less than 40 percent for these below 35.

“The housing market has been extremely risky over the past 4 years in a means that has made it very salient,” mentioned Igor Popov, the chief economist at Condominium Listing. “I believe housing goes to be an enormous matter within the 2024 election.”

But there are causes that presidential candidates have not often emphasised housing as an election problem: It’s each a long-term drawback and a tricky one for the White Home to sort out by itself.

“Housing is form of the issue youngster in financial coverage,” mentioned Jim Parrott, a nonresident fellow on the City Institute and former Obama administration financial and housing adviser.

America has a housing provide shortfall that has been years within the making. Builders pulled again on building after the 2007 housing market meltdown, and years of inadequate constructing have left too few properties in the marketplace to satisfy current sturdy demand. The scarcity has just lately been exacerbated as larger rates of interest deter home-owning households who locked in low mortgage charges from shifting.

Situations may ease barely in 2024. The Federal Reserve is anticipated to start reducing borrowing prices subsequent 12 months as inflation eases, which may assist to make mortgages barely cheaper. A brand new provide of flats are anticipated to be completed, which may preserve a lid on rents.

And even voters who really feel unhealthy about housing may nonetheless help Democrats for different causes. Ms. Ambrosy, the would-be purchaser in St. Paul, mentioned that she had voted for President Biden in 2020 and she or he deliberate to vote for the Democratic nominee on this election purely on the premise of social points, as an example.

However housing affordability is sufficient of a ache level for younger voters and renters — who are inclined to lean closely Democrat — that it has left the Biden administration scrambling to emphasise potential options.

After together with emergency rental help in his 2021 financial stimulus invoice, Mr. Biden has devoted much less consideration to housing than to different inflation-related points, like lowering the price of prescribed drugs. His most aggressive housing proposals, like an growth of federal housing vouchers, had been dropped from final 12 months’s Inflation Discount Act.

Nonetheless, his administration has pushed a number of efforts to liberalize native housing legal guidelines and broaden reasonably priced housing. It launched a “Housing Supply Action” plan that goals to step up the tempo of improvement by utilizing federal grants and different funds to encourage state and native governments to liberalize their zoning and land use guidelines to make housing sooner and simpler to construct. The plan additionally provides governments extra leeway to make use of transportation and infrastructure funds to extra immediately produce housing (akin to with a brand new program that helps the conversion of offices to apartments).

The administration has additionally floated quite a few concepts to assist renters, akin to a blueprint for future renters’ laws and a brand new Federal Commerce Fee proposal to ban “junk fees” for issues like roommates, purposes and utilities that conceal the true price of hire.

Some reasonably priced housing advocates say the administration may do extra. One risk they’ve raised prior to now can be to have Fannie Mae and Freddie Mac, which assist create a extra strong marketplace for mortgages by shopping for them from monetary establishments, make investments immediately in reasonably priced rental housing developments. Ms. Raghuveer, the tenant organizer, has argued that the Federal Housing Finance Company, which regulates Fannie Mae and Freddie Mac, may unilaterally impose a cap on annual hire will increase for landlords whose mortgages are backed by the agencies.

However a number of specialists mentioned that White Home efforts would solely assistance on the margins. “With out Congress, the administration is absolutely restricted in what they will do to cut back provide obstacles,” mentioned Emily Hamilton, an economist on the Mercatus Heart who research housing.

Republicans management the Home and have opposed practically all of Mr. Biden’s plans to extend authorities spending, together with for housing. However aides say Mr. Biden will press the case and search new government actions to assist with housing prices.

Whereas it might be priceless to start out speaking about options, “nothing goes to unravel the issue in a single 12 months,” mentioned Mark Zandi, chief economist of Moody’s Analytics and a frequent adviser to Democrats.

“This drawback has been growing for 15 years, for the reason that monetary disaster, and it’s going to take one other 15 years to get out of it.”