Key Factors

- PriceSmart pops 10% after reporting a stable quarter with prime and bottom-line energy.

- The Q1 report reveals quite a few levers for development and earnings that can play out in 2024.

- The inventory provides worth and yield in comparison with US-based opponents and is a stable play on EMs.

- 5 shares we like higher than PriceSmart

PriceSmart NASDAQ: PSMT, pretty much as good an funding as it’s, has struggled to realize traction with value shares, however that wrestle is ending. PriceSmart is well-positioned typically however particularly for 2024 as a result of its enterprise facilities on EMs in Latin America, rising organically and constructing leverage through retailer rely and membership development. The takeaway is that this firm is constructing a useful lever for shareholder returns, and the Q1 outcomes have this market on the transfer. Shares are up 10% in pre-market motion, confirming help at essential ranges and indicating a excessive likelihood of a sustained rally.

PriceSmart is levered for achievement

Shares are up on what can solely be known as a stable report. The corporate reported $1.17 billion in income for a achieve of 11.4% over final yr. That is barely higher than the analyst forecast however extra vital as a result of its bigger, US-centric opponents like Walmart NYSE: WMT and Costco Wholesale NASDAQ: COST are solely anticipated to develop 3% and 5% within the comparable quarter. Web merchandise gross sales are up 10.7%, aided by a 6% improve in retailer rely, 6.8% FX tailwind, 4.3% natural comp gross sales development and an 11% improve in membership.

The mixed impression of a number of development levers resulted in a major margin enchancment. The corporate’s GAAP and adjusted earnings grew by 15% to outpace the highest line by 360 foundation factors. The earnings are $0.12 higher than anticipated, and energy ought to proceed into the 2nd quarter.

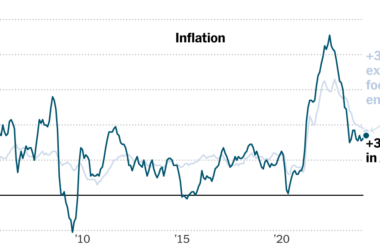

PriceSmart didn’t give steerage within the press launch however is ready up for energy in 2024. Latin America and the Caribbean development is predicted to speed up to 2.3% in 2024 after which to 2.5% in 2025, outpacing the US by 150 foundation factors or extra. The corporate can also be constructing momentum with retailer rely, membership, and comp gross sales, which aren’t totally mirrored within the quarterly outcomes. Analysts may additionally underestimate the corporate’s potential, forecasting 10% top-line development in 2024.

PriceSmart is worth and yield amongst membership golf equipment

PriceSmart provides worth and yield to buyers on prime of a possibility for market-leading development. The inventory trades at solely 16.5X this yr and 15.5X subsequent yr’s earnings estimates, whereas Walmart is nearer to 24X and 22X and Costco within the low-40s. All three pay dependable dividends, Walmart the best with a yield close to 1.45%, however worth and the outlook for distribution development make PriceSmart an amazing play for buyers with time on their palms.

The 1.25% payout ratio is lower than 25% of the 2024 earnings forecast and well-covered by money stream. The steadiness sheet has some debt, however is internet money, and leverage is low. Dividend will increase is probably not nice; the CAGR is within the mid-single-digit vary, however annual will increase could also be sustained for a lot of a long time with numbers like this. The steadiness sheet and money stream additionally permit for share repurchases; the share rely is down 1.45% YOY on the finish of Q1.

Establishments and analysts help the motion in PriceSmart

Marketbeat solely tracks two analysts with protection on PriceSmart, however they’re bullish on the identify. They fee the inventory at Reasonable Purchase and see it buying and selling close to $82. That leaves little meat on the bone for brand spanking new buyers however is probably going a low goal; the Q1 outcomes could spur them to revisions. The freshest protection is from Jeffries, which was initiated in December 2023.

Establishments personal about 82% of the inventory and purchased on steadiness the primary three quarters of 2023. They turned bearish in This autumn, aligning with the dip within the value motion, however the Q1 2024 motion to this point is 100% shopping for. The highest two holders are BlackRock and Vanguard, which account for 22% of the inventory; quite a few holders are additionally within the 1% to 9% vary.

The technical outlook: PriceSmart confirms help

The value motion in PriceSmart is up 10% in premarket buying and selling, indicating stable help on the 150-day and 30-day EMAs. This motion reveals help from brief and long-term merchants and will flip right into a sustained rally. The danger is resistance close to $82. The height set in August coincides with the analysts’ consensus and will cap good points. A transfer above $82 could be bullish and will take the market up the $90 area by mid-year.

Earlier than you contemplate PriceSmart, you may need to hear this.