Key Factors

Shares have been holding onto good points since final week’s earnings report and bullish ahead steering.

A bunch of analyst upgrades underlines the chance right here.

Traders ought to search for shares to complete consolidating this week and begin shifting greater from Monday.

5 shares we like higher than Block

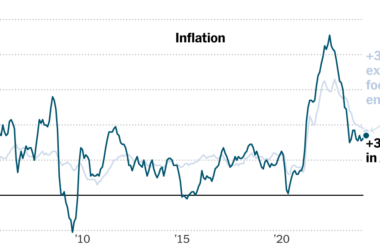

Having traded principally sideways since January, Block, Inc. NYSE: SQ shares are once more on the transfer. They’d carried out strongly all by the ultimate two months of final yr when, like with nearly all equities, they took off on the again of cooling inflation knowledge and hopes of an imminent charge reduce.

This newest pop, which sees them buying and selling on the prime of a two-year vary, comes on the again of a powerful earnings report final week and bullish analyst feedback within the aftermath. Final Thursday, Block, a widely known fintech for SMEs and beforehand often known as Sq., reported This autumn outcomes that topped analyst expectations on the income entrance and set the tone for what needs to be a powerful yr. Income was up a powerful 24% yr on yr and effectively forward of the consensus, which greater than made up for the miss on their bottom-line earnings.

Bullish Steering for Block Inventory

It additionally helped that administration’s ahead steering for full-year EBITDA got here in at $2.63 billion, effectively forward of their earlier steering of $2.4 billion. A rosier-than-expected outlook on a key metric like this can outweigh nearly any unfavorable shock concerning historic efficiency from a earlier quarter. Traders are nothing if not forward-looking, and with inflation certainly persevering with to chill, there are sufficient tailwinds in place for Block to proceed rallying all through 2024.

This was a chance referred to as out by the Seaport Analysis staff, who upgraded their ranking on Block shares within the aftermath of final week’s report. Having beforehand had Block rated as Impartial, their staff upped it to a bullish Purchase ranking, saying that they “see ample alternative for additional working leverage from right here.” Seaport additionally raised its 2024/25 forecasts for Block’s EBITDA and sees the continuing power within the enterprise’ fundamentals persevering with all over 2026.

For these of us weighing up a place in Block, there’s a whole lot of consolation available from such bullish stances as these by analysts. Additionally becoming a member of the bull camp not too long ago was the Wells Fargo staff, who, with their $95 worth goal, are on the lookout for additional upside of no less than 16% from the place shares closed on Thursday. If Block shares make their approach up there within the coming weeks, they’d be at multi-year highs and, certainly, at their highest degree since earlier than 2022’s slide bottomed out. They’d even have gained greater than 100% in worth since November’s low and could be effectively on their approach to getting again to the triple-digit costs the place they spent a lot of 2020 and 2021.

Getting Concerned with Block Inventory

The truth that shares softened considerably after final week’s preliminary pop can have finished no hurt in any respect to the bull thesis. They’ve already turned north as soon as once more, which implies there is a stable line of help beneath them, and there is some actual momentum beginning to stream in with the earnings report now having been totally digested. Traders needs to be comfy beginning to construct a place round right here and be prepared so as to add to it if Block breaks by the $82 line, as that’s the place the closest resistance is.

Contemplating that alongside Seaport and Wells Fargo, bullish stances have additionally been taken on Block’s prospects by the groups at Piper Sandler, Canaccord, and Citigroup, with a street-high worth goal of $100 coming from Truist Monetary, it looks like this might be the beginning of one thing massive.

With equities persevering with to profit from the return of sturdy risk-on sentiment, as buyers proceed to flood again into shares, now’s the time to pick these which are set to outperform probably the most. When you’ve a inventory like Block, which is saying it is going to just do that within the yr forward however whose shares are solely simply now preparing for lift-off, you need to be prepared to start out backing up the truck. Earlier than you contemplate Block, you may need to hear this.MarketBeat retains monitor of Wall Road’s top-rated and greatest performing analysis analysts and the shares they suggest to their shoppers each day. MarketBeat has recognized the 5 shares that prime analysts are quietly whispering to their shoppers to purchase now earlier than the broader market catches on… and Block wasn’t on the record.View The 5 Shares Right here Do you anticipate the worldwide demand for power to shrink?! If not, it is time to try how power shares can play an element in your portfolio.Get This Free Report

March 1, 2024

Read next

January 9, 2024

Key Factors Apple has lagged the broader market for the reason that center of final month. Traditionally, its…

3 min read

December 12, 2023

Key Factors Corporations proceed to reference synthetic intelligence of their earnings experiences, however is…

4 min read

January 30, 2024

Key Factors Williams-Sonoma inventory offered off by 6.6% this week after rising delivery and gas prices…

4 min read

February 29, 2024

Key Factors The TJX Corporations had a strong quarter regardless of tepid outcomes relative to analysts’…

4 min read