Key Factors

MongoDB had a strong quarter, with progress sustaining above 25% for an additional quarter, however steering was weak.

MongoDB Atlas is gaining traction and has grown to 68% of income.

Analysts are resetting their targets however stay bullish and see a 15% upside on the consensus.

5 shares we like higher than Adobe

Outcomes from MongoDB Inc. NASDAQ: MDB and GitLab Inc. NASDAQ: GTLB counsel a bubble is bursting within the AI market that might impression names like Oracle Corp. NYSE: ORCL, Adobe Inc. NASDAQ: ADBE and Microsoft Inc. NASDAQ: MSFT.

Nonetheless, a bubble bursting doesn’t imply the top of AI; it is just a reset of expectations. The outcomes from each software program corporations reveal power of their choices, however steering undercuts value motion and valuation.

Each guided for progress, solely lower than what the analysts have been forecasting. It is not both firm’s fault it could not reside as much as what essentially the most optimistic analysts anticipated; excessive double-digit progress and broader margins are good. It could take time for the market to regain confidence, however will doubtless set new highs.

We’re nonetheless within the earliest innings of the AI revolution, and there’s a strong outlook for progress, money circulate and earnings. MongoDB core database product is gaining traction as a must have software for cloud customers due to Atlas and can develop with the trade. Atlas is a completely managed database that manages and deploys MongoDB throughout cloud borders. The most recent information contains quite a few deployments throughout Google Cloud, Amazon.com Inc. NASDAQ: AMZN, AWS and Microsoft Azure, bringing the whole to 117 cloud areas and offering extra leverage for future outcomes.

MongoDB has a Strong Quarter: Steering is Cautious

MongoDB had a strong This fall, with income up 26.8% over final yr. The highest line beat the consensus by 500 foundation factors and is on high of a 36% enhance final yr. Buyer progress drives power and the widening availability of Atlas. MongoDB Atlas accounts for 68% of the income and is gaining floor. Subscriptions led and are up 28% year-over-year (YoY), offset by a 1% decline in providers.

Margin information is an space of power. The gross margin held flat at 75% GAAP and 77% adjusted, however the working margin widened. The working margin widened by 500 foundation factors on enhancing income leverage regardless of elevated spending and left adjusted web earnings and free money circulate effectively above expectations. The adjusted earnings got here in at $0.86 or up 50% and practically double consensus, with FCF doubling to $50.5 million.

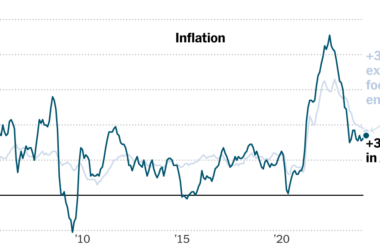

Steering is the weak spot within the information, though income is anticipated to develop by 15% this yr. The unhealthy information is that Q1 and FY outcomes are effectively beneath the consensus, main the market to reset its expectations. Given the outlook for cloud spending this yr, the chance is that steering is probably going cautious. Cloud spending is anticipated to speed up to +20%, with progress led by the highest three gamers, Azure, AWS and Google. MongoDB is completely positioned to profit from that progress.

Analysts Revise Targets for MongoDB: See Double-Digit Upside

The analysts’ exercise is sizzling following the This fall launch and steering replace, with greater than a dozen of the twenty-five analysts tracked by Marketbeat issuing revisions. The exercise is blended with a number of lowered-priced targets and a few elevated, however the takeaway is bullish. The sentiment is firming from “reasonable purchase” to “purchase” with an improve issued by D.A. Davidson, elevating its value goal to $430 and close to consensus.

The consensus goal implies a 15% upside and is trending increased, and it is able to lead the market now that the value motion has corrected.

Earlier than you contemplate Adobe, you will need to hear this.MarketBeat retains observe of Wall Road’s top-rated and finest performing analysis analysts and the shares they advocate to their shoppers each day. MarketBeat has recognized the 5 shares that high analysts are quietly whispering to their shoppers to purchase now earlier than the broader market catches on… and Adobe wasn’t on the record.Whereas Adobe at present has a “Average Purchase” ranking amongst analysts, top-rated analysts imagine these 5 shares are higher buys.View The 5 Shares Right here Click on the hyperlink beneath and we’ll ship you MarketBeat’s information to investing in electrical car applied sciences (EV) and which EV shares present essentially the most promise. Get This Free Report