If the financial system is slowing down, no person instructed the labor market.

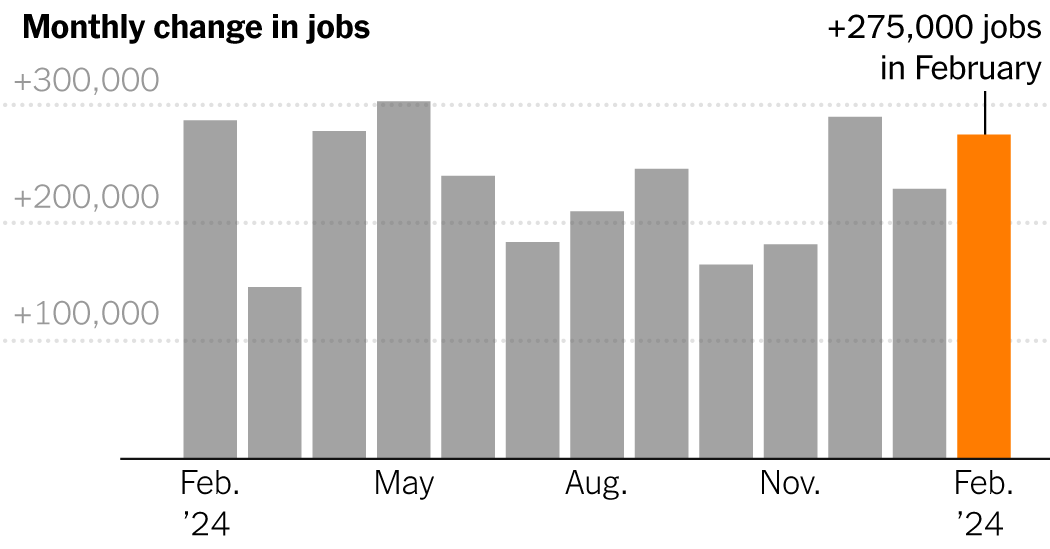

Employers added 275,000 jobs in February, the Labor Department reported Friday, in one other month that exceeded expectations even because the unemployment charge rose.

It was the third straight month of seasonally adjusted features above 200,000, and the thirty eighth consecutive month of development — recent proof that 4 years after going into pandemic shutdowns, America’s jobs engine nonetheless has loads of steam.

“We’ve been anticipating a slowdown within the labor market, a extra materials loosening in situations, however we’re simply not seeing that,” mentioned Rubeela Farooqi, chief economist at Excessive Frequency Economics.

Beforehand reported figures for December and January had been revised downward by a complete of 167,000, reflecting the upper diploma of statistical volatility within the winter months. That doesn’t disrupt an image of constant, sturdy will increase.

On the identical time, the unemployment charge, primarily based on a survey of households fairly than companies, elevated to a two-year excessive of three.9 %. The rise from 3.7 % in January was pushed by individuals shedding or leaving jobs in addition to these coming into the labor pressure to search for work.

A extra expansive measure of slack labor market situations, which incorporates individuals working half time who would fairly work full time, has been steadily rising and now stands at 7.3 percent.

In a optimistic signal, the labor pressure participation charge for individuals of their prime working years — ages 25 to 54 — jumped to 83.5 %, matching a stage from final 12 months that was the best because the early 2000s. The participation charge for these over age 55 stays markedly beneath its prepandemic stage, probably partly as a result of the booming housing and inventory markets have allowed extra individuals to retire.

Common hourly earnings rose by 4.3 % over the 12 months. Wages have outpaced costs since Might, although the tempo of will increase has been fading.

“We’ve lately seen features in actual wages, and that’s inspired individuals to re-enter the labor market, and that’s a great improvement for staff,” mentioned Kory Kantenga, a senior economist on the job search web site LinkedIn. As wage development slows, he mentioned, the probability that extra individuals will begin in search of work falls.

As late as final fall, economists had been predicting way more modest employment will increase, with hiring concentrated in just a few industries. Some pandemic-inflated industries have shed jobs, however anticipated downturns in sectors like development haven’t materialized.

The previous couple of months have been studded with robust financial information, prompting analysts surveyed by the Nationwide Affiliation for Enterprise Economics to lift their forecasts for gross home product and decrease their expectations for the trajectory of unemployment. Inflation has eased, main the Federal Reserve to telegraph its plans for rate of interest cuts someday this 12 months, which many see as insurance coverage ought to the job market stumble.

Mervin Jebaraj, director of the Heart for Enterprise and Financial Analysis on the College of Arkansas, helped tabulate the survey responses. He mentioned the temper was buoyed partly by fading trepidation over federal authorities shutdowns and draconian finances cuts, after a number of shut calls because the fall. And there’s no hurt, he mentioned, in a tamer however extra sustainable tempo.

“If we acquire 150,000 jobs each month this 12 months, that will nonetheless be an unimaginable 12 months, however it will nonetheless be cooling in comparison with final 12 months,” Mr. Jebaraj mentioned. “And possibly we would like each issues.”

Furthermore, a few of the cooling could have allowed for extra sturdy development. As excessive labor shortages eased and the wave of job quitting subsided, employers unable to win bidding wars for staff have had a better time filling positions. And as individuals stick round longer, productiveness has improved, which makes it simpler to pay extra with out rising costs.

Well being care and authorities once more led the payroll features in February, whereas development continued its regular improve. Retail, eating places, transportation and warehousing, which have been flat to destructive in current months, picked up.

No main industries misplaced a considerable variety of jobs. Excessive rates of interest proceed to suppress manufacturing, nonetheless, whereas credit score intermediation continued its downward slide — that sector, which largely contains business banking, has misplaced about 123,000 jobs since early 2021.

Few companies are extra emblematic of the facility behind current employment features than dwelling well being companies for older individuals, which rely 164,000 extra jobs than earlier than the pandemic — fully offsetting the decline of nursing and residential care services, which have been much less in style since Covid-19 ripped by them in 2020.

Elaine Flores is the chief working officer of Medical Residence Care Professionals, an company in Redding, Calif., that employs 102 scientific workers members and caregivers. That’s up about 20 % since early 2020, although the web acquire underestimates how many individuals she’s needed to rent as skilled suppliers have left the career.

“Increasingly nurses are retiring out,” Ms. Flores mentioned. “That’s most likely probably the most tough self-discipline to recruit, and we compete towards hospitals, which have stunning advantages packages that, on dwelling well being margins, we will’t do.”

Elevated ranges of immigration could assist with that downside within the coming years. In keeping with an analysis by the Brookings Institution, the inflow during the last two years has roughly doubled the variety of jobs that the financial system might add per thirty days in 2024 with out placing upward strain on inflation, to a spread of 160,000 to 200,000.

That doesn’t imply the employment panorama appears rosy to everybody. Worker confidence, as measured by the company rating website Glassdoor, has been falling steadily as layoffs by tech and media firms have grabbed headlines. That’s very true in white-collar professions like human sources and consulting, whereas these in occupations that require working in particular person — resembling well being care, development and manufacturing — are extra upbeat.

“It’s a two-track labor market,” mentioned Aaron Terrazas, Glassdoor’s chief economist, noting that job searches are taking longer for individuals with graduate levels. “For expert staff in risk-intensive industries, anybody who’s been laid off is having a tough time discovering new jobs, whereas for those who’re a blue-collar or frontline service employee, it’s nonetheless aggressive.”

These having a tough time discovering regular employment flip more and more to gig work, Mr. Terrazas famous, which isn’t picked up within the payrolls information. That has been true for Clifford Johnson, 70, who retired from his accounting job in Orlando, Fla., three years in the past and commenced drawing Social Safety.

The outlook modified when Mr. Johnson separated from his husband and needed to hire an residence, which within the scorching Orlando housing market prices $2,350 a month. He has not landed one other accounting job, and a retail place didn’t work out. He has run by his restricted financial savings, and for now he drives for Uber Eats full time — even on the weekend — to remain afloat.

“I’m simply doing what I can do to make cash each day,” Mr. Johnson mentioned. He’s hoping a few contract accounting positions come by, since driving that a lot is bodily exhausting. “If you happen to’re 25 or simply graduating from faculty, it’s quite a bit totally different than for those who’re 70 and nonetheless attempting to make a dwelling.”

The trail ahead for the labor market, which few have managed to precisely predict, stays hazy. Each seeming menace thus far — together with wars, substantial rate of interest will increase and financial institution collapses — has been met with unflappability.

Thomas Simons, senior economist on the funding banking agency Jefferies, thinks the financial system will look weaker on the finish of the 12 months than it does now, regardless of the shortage of any apparent potholes.

“It’s been 30-plus years since we’ve had an financial cycle like this, the place we’re ready for sufficient drag to coalesce between totally different sectors to take the entire quantity down,” Mr. Simons mentioned. “I nonetheless imagine it’s unlikely that it’s going to proceed indefinitely, even and not using a discrete catalyst.”