Key Factors

- Intuitive Machines is a big participant in lunar exploration, with successes within the Artemis program, however it faces monetary challenges in a aggressive house market.

- The corporate’s income is pushed by NASA contracts and the OMES III program, with efforts to diversify into industrial lunar knowledge providers providing the potential for development.

- Traders ought to take into account Intuitive Machines’ current earnings, the standing of its lunar lander mission, and the inherent dangers of the aerospace business when evaluating the inventory.

- 5 shares we like higher than Intuitive Machines

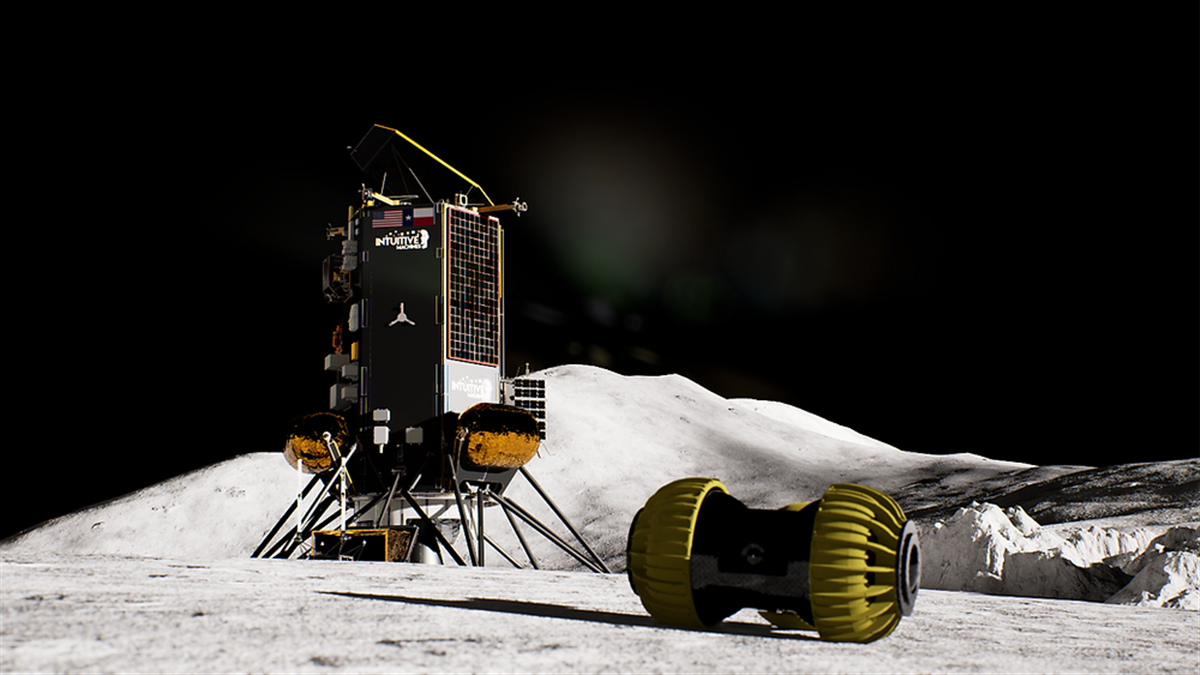

Intuitive Machines NASDAQ: LUNR has positioned itself as a pivotal participant within the house exploration and aerospace sector, the place ambition and innovation collide. Intuitive Machines embodies the spirit of the brand new house age from its historic lunar touchdown, marking the United State’s return to the Moon after a hiatus of over 50 years, to its increasing portfolio of lunar applied sciences and providers.

Intuitive Machine’s earnings launch for the fourth quarter and full yr of 2023 (This fall FY 2023) supplies an in depth image of the corporate’s monetary efficiency and gives clues about its trajectory. After a profitable lunar landing, has Intuitive Machines landed a compelling monetary report, setting the stage for a protracted and worthwhile mission?

Houston, We Have Income Development

The corporate’s newest earnings report reveals a mixture of progress and continued challenges in Intuitive Machines’ monetary efficiency. The corporate skilled a year-over-year income lower. In FY 2023, income reached $79.5 million in comparison with $85.9 million in FY 2022. This lower is primarily attributable to venture milestones and contract completion timing.

NASA’s Business Lunar Payload Companies (CLPS) initiative and the more moderen OMES III contract are key drivers of the corporate’s income. It is necessary to notice that authorities contracts can have income recognition patterns that impression the timing of revenue mirrored on monetary statements.

Whereas Intuitive Machines recorded a internet working lack of $(56.2) million in FY 2023, a narrower lack of $(5.9) million within the fourth quarter of 2023 is encouraging. This discount in quarterly working loss signifies efforts to rein in prices. Moreover, attaining a optimistic gross margin in December 2023, primarily because of OMES III income, highlights enhancing operational effectivity.

This optimistic margin signifies that the corporate generates an appropriate revenue after deducting direct prices related to delivering its lunar providers.

Intuitive Machines ended 2023 with a strong backlog of $268.6 million, a rise from $201.9 million within the prior yr. Backlog denotes contracted work but to be accomplished and translated into income. Thus, this substantial backlog bodes nicely for future income potential.

The corporate’s money place strengthened significantly, reaching $54.6 million by March 1, 2024. This enhance resulted primarily from warrant workout routines by an institutional investor, offering enhanced monetary flexibility to pursue development initiatives and investments.

Statements made through the earnings name indicated Intuitive Machines will proceed to concentrate on innovation, strategic partnerships, value management, and environment friendly execution of its increasing lunar packages. Navigating the cost-intensive aerospace business stays difficult, however income development, enhancing margins, a wholesome backlog, and ample money reserves provide encouraging indicators.

Lunar Ambitions in a Aggressive Orbit

NASA’s Artemis marketing campaign represents a serious frontier in Twenty first-century lunar exploration, and Intuitive Machines performs a big function on this endeavor. Their profitable lunar touchdown mission demonstrated the corporate’s technical proficiency and bolstered its popularity throughout the business.

If Intuitive Machines efficiently monetizes lunar knowledge and participates in creating lunar useful resource utilization efforts, important new income streams might be unlocked.

Nonetheless, it is important to acknowledge that Intuitive Machines will not be the only participant within the industrial house race. Firms like Astrobotic and Firefly Aerospace additionally vie for dominance in lunar markets.

To take care of and develop its market share, Intuitive Machines should repeatedly refine its worth proposition, highlighting the distinctive benefits of its providers and applied sciences. Success on this aggressive panorama hinges on demonstrating innovation and delivering dependable efficiency.

Countdown to Investor Affect

The present standing of Intuitive Machines’ lunar lander is a essential issue for buyers to watch. The lander’s potential to efficiently restart upon the return of ample daylight to its South Pole touchdown web site will decide the instant consequence of the mission and certain considerably impression within the close to time period.

Past the lunar lander, buyers ought to carefully observe any current information developments or bulletins from Intuitive Machines. New strategic partnerships, contract wins, or management modifications might sign optimistic momentum or potential challenges for the corporate.

Moreover, it is essential to concentrate to shifts in . Main shareholders shopping for or promoting sizable quantities of can convey both confidence within the firm’s future or elevate considerations about its trajectory.

Whereas these particular updates provide insights into Intuitive Machines’ outlook, buyers should additionally concentrate on the broader dangers that characterize the aerospace sector. This business is thought for being capital-intensive, requiring important investments in expertise improvement and infrastructure.

Tasks typically have prolonged timelines, that means that returns on funding might not be realized for years. Contemplating these inherent dangers is crucial when making knowledgeable funding selections about any aerospace firm, together with Intuitive Machines.

Intuitive Machines embodies the spirit of the transformative age in house exploration. The corporate’s profitable lunar touchdown, participation within the Artemis program, and push for industrial house actions underscore its ambition. Traders should fastidiously weigh the corporate’s sturdy income development, promising backlog, and technological developments towards the working losses, aggressive panorama, and dangers attribute of the aerospace business.

As Intuitive Machines continues to chart its course amongst the celebrities, staying attuned to firm developments will information knowledgeable funding selections.

Earlier than you take into account Intuitive Machines, you will wish to hear this.

MarketBeat retains observe of Wall Avenue’s top-rated and greatest performing analysis analysts and the shares they advocate to their purchasers every day. MarketBeat has recognized the 5 shares that high analysts are quietly whispering to their purchasers to purchase now earlier than the broader market catches on… and Intuitive Machines wasn’t on the listing.

Whereas Intuitive Machines at present has a “Purchase” score amongst analysts, top-rated analysts consider these 5 shares are higher buys.

View The 5 Shares Right here

Do you anticipate the worldwide demand for vitality to shrink?! If not, it is time to try how vitality shares can play an element in your portfolio.