Key Factors

Greenbrier Firms’ enterprise is stable following the 2021-2022 provide chain log jams, and a return to progress is coming.

Money move and capital returns are stable and can assist maintain the rally in 2024.

Analysts favored the Q2 outcomes and are elevating their worth targets, main the market.

5 shares we like higher than Greenbrier Firms

It’s an thrilling time for Greenbrier Firms NYSE: GBX buyers, though it is not precisely an thrilling firm. The enterprise manufactures, markets, companies and leases railroad automobiles. The takeaway from the FQ2 outcomes is that enterprise is stable, and the outlook is firming: an outlook for sustained operational high quality, a pivot again to progress and widening margins. What this implies for buyers is that the lightly-valued, 2.25% yielding inventory is on monitor to proceed rallying greater in 2024 and can seemingly set new long-term highs by yr finish.

Get Greenbrier Firms alerts:Signal UpGreenbrier Firms Exceeds Expectations and Guides Greater

Greenbrier Firms had a good quarter in Q2 regardless of the YOY decline in enterprise. The decline is primarily resulting from transportation market normalization following the availability chain hiccups of 2021 and 2023, and a income trough is forming. The $863 million in internet income is 250bps higher than anticipated, and the margin particulars are additionally stable. All working segments have been robust, with sequential progress within the major manufacturing phase approaching 10%.

The margin is nice. The corporate skilled some contraction sequentially, however the margin expanded in comparison with final yr, offering a slight earnings progress on the underside line. The GAAP $1.03 is 13 cents higher than the consensus reported by Marketbeat and two cents higher than final yr.

New Orders, Backlog and steering all help the outlook for continued sequential enchancment and a pivot again to progress. New orders grew by 5,900 items and outpaced deliveries. The web enhance in new orders elevated the backlog, which stands at 29,200 items and is rising. The backlog is sufficient to maintain operations at present ranges for almost 18 months and performs into the steering.

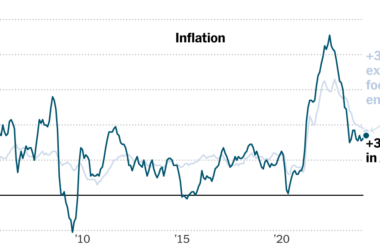

The corporate raised its steering for FY income and earnings to a spread with a midpoint above the consensus, and steering could also be cautious resulting from underlying enterprise momentum and the FOMC. The timing of FOMC fee cuts is questionable, however cuts are coming and can speed up financial exercise once they do. Till then, financial exercise is resilient.

Greenbrier’s Capital Returns Are Protected for 2024 and 2025

Greenbrier gives a value-yield alternative that revenue buyers will like. The inventory yields about 2.25%, buying and selling at solely 12.7x its earnings outlook, which is favorable. The yield is just 30% of earnings, with earnings forecast to develop this yr and subsequent. The stability sheet is wholesome, bordering on fortress high quality, with internet debt working at 1x fairness and 0.25x belongings.

The corporate’s money move additionally permits for share repurchases, which have the common diluted rely down by 3.7% on the finish of the quarter. As a result of the corporate’s stability sheet and money move are unencumbered and it elevated the distribution final yr, there’s a likelihood GBX inventory will elevate the distribution once more this yr. If that’s the case, it should seemingly occur on the finish of the present quarter when Q3 outcomes are launched.

Analysts Lead GBX Inventory to New Highs

Analysts’ sentiment in GBX inventory is shifting for the higher and main the market greater. The post-release exercise has the sentiment as much as Maintain from Scale back and the value goal rising. The consensus lags behind the market however is up 25% in 30 days, with the freshest targets starting from $60 to $65. A transfer to $60 is value greater than 1000bps and places the inventory at a five-year excessive, on monitor for a recent decade excessive.

The insiders are a threat, as they personal about 2.55% of the corporate and are promoting into the rally. They’re unlikely to cap good points indefinitely however could trigger volatility because the market advances. Institutional exercise offsets the insiders’ shopping for and has their possession on the rise. Establishments personal almost 96% of the inventory and are unlikely sellers due to the outlook for operations, money move and capital returns.

MarketBeat retains monitor of Wall Road’s top-rated and greatest performing analysis analysts and the shares they advocate to their shoppers every day. MarketBeat has recognized the 5 shares that prime analysts are quietly whispering to their shoppers to purchase now earlier than the broader market catches on… and Greenbrier Firms wasn’t on the checklist.Whereas Greenbrier Firms presently has a “Maintain” ranking amongst analysts, top-rated analysts consider these 5 shares are higher buys.View The 5 Shares Right here Click on the hyperlink under and we’ll ship you MarketBeat’s information to investing in electrical automobile applied sciences (EV) and which EV shares present essentially the most promise. Get This Free Report

April 9, 2024

Read next

January 23, 2024

Key Factors Proctor & Gamble had a stable quarter with spectacular margins. Money move and FCF are enough to…

4 min read

January 15, 2024

Key Factors An sudden army conflict within the Pink Sea might show bullish for oil costs. Nonetheless,…

4 min read

January 19, 2024

Key Factors SLB had a stable quarter, outperforming estimates and guiding for one more 12 months of robust…

4 min read

January 30, 2024

Key Factors Williams-Sonoma inventory offered off by 6.6% this week after rising delivery and gas prices…

4 min read