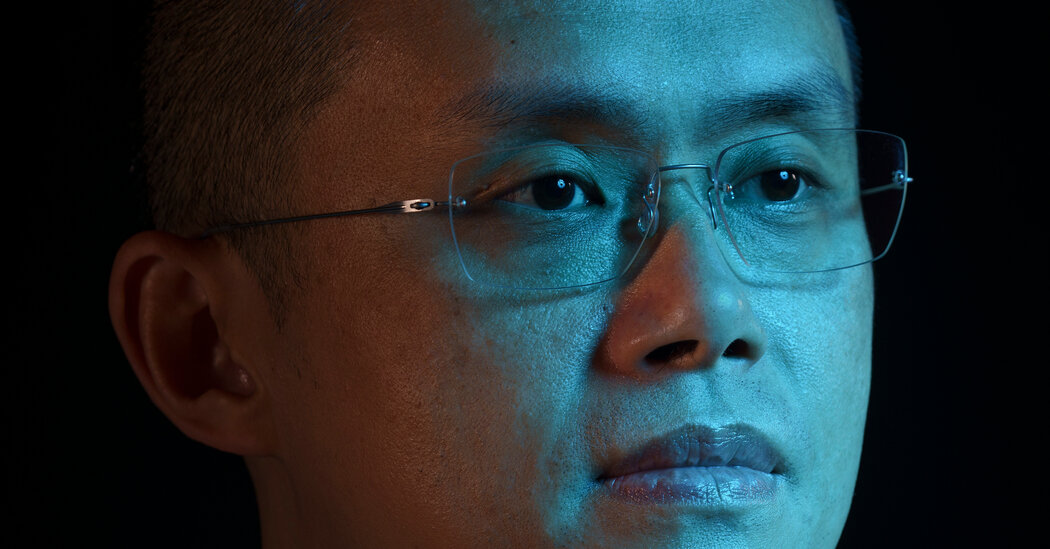

Changpeng Zhao, the founding father of the large cryptocurrency alternate Binance, ought to go to jail for 3 years after breaking the regulation “on an unprecedented scale” and pleading responsible to a money-laundering violation, federal prosecutors wrote in a court docket submitting on Wednesday.

Protection attorneys countered in their very own memo that Mr. Zhao, 47, ought to obtain no jail time and face a sentence of probation, arguing that he had accepted accountability for his crime and confirmed a dedication to philanthropy.

A federal decide in Seattle, Richard A. Jones, is about to judge these dueling suggestions at a sentencing listening to for Mr. Zhao on Tuesday. His sentencing would be the newest landmark in a sequence of felony prosecutions which have focused a few of the strongest figures within the world cryptocurrency trade.

Simply 18 months in the past, Mr. Zhao, using excessive as Binance’s chief government, helped set off the chain of occasions that led to the collapse of FTX, Binance’s largest rival, and the imprisonment of the FTX founder Sam Bankman-Fried, who was sentenced to 25 years for fraud. Now Mr. Zhao faces his personal jail sentence after slicing a cope with prosecutors in November, admitting that he did not arrange an ample system at Binance to forestall cash laundering.

Beneath federal tips, that crime carries a sentence of 12 to 18 months, prosecutors wrote of their memo. They famous that the U.S. probation division had really helpful 5 months behind bars for Mr. Zhao. However the authorities is searching for a three-year sentence, the memo mentioned, due to the “the scope and ramifications” of Mr. Zhao’s conduct.

As Binance’s founder, Mr. Zhao was as soon as arguably essentially the most highly effective government within the cryptocurrency trade. At instances, Binance processed as a lot as two-thirds of all crypto transactions. Mr. Zhao has a fortune worth $33 billion, in keeping with Forbes.

However for years, he was dogged by accusations that Binance had damaged the regulation to develop its enterprise worldwide. In November, the corporate agreed to pay $4.3 billion in fines and restitution to the U.S. authorities, settling prices that it had violated financial sanctions in opposition to Syria, Cuba and Iran whereas permitting felony exercise to flourish on its platform.

Individually, Mr. Zhao pleaded responsible to failing to take care of an ample anti-money-laundering program at Binance. As a part of the deal, he agreed to pay a $50 million advantageous and step down as Binance’s chief government. He was changed by Richard Teng, a former regulator in Singapore who had been groomed to succeed him.

In court docket papers, Mr. Zhao admitted to prioritizing Binance’s development over its compliance with the Financial institution Secrecy Act, which requires firms to keep away from doing enterprise with criminals or folks going through financial sanctions. He instructed Binance’s staff that it was “higher to say sorry than permission,” court docket papers mentioned, and allowed Binance prospects to create accounts with out sharing the kind of detailed private info that monetary companies corporations normally require.

“Zhao’s sentence ought to replicate the gravity of his crimes,” prosecutors wrote within the submitting on Wednesday. “Zhao and Binance put U.S. prospects, the U.S. monetary system and U.S. nationwide safety in danger.”

Of their memo, Mr. Zhao’s attorneys argued that he deserved lenience, emphasizing that he got here to the US from his residence within the United Arab Emirates to plead responsible. They wrote that whereas Mr. Zhao had admitted to a compliance failure at Binance, he had not pleaded responsible to participating in cash laundering, fraud or theft.

“Mr. Zhao shouldn’t be a logo. He’s a loyal father, a philanthropist,” the protection memo mentioned. “He has already proven regret for his offense and, extra importantly, has remediated.”

The memo included letters from Mr. Zhao’s associates and Binance staff, a few of whom wrote that the corporate was working laborious to cooperate with regulation enforcement organizations world wide. Protection attorneys solid Mr. Zhao as “frugal and humble,” saying he supposed to provide away 90 to 99 p.c of his wealth.

Among the many letter writers have been Mr. Zhao’s two grownup youngsters, each college students at American universities, and Max Baucus, a former U.S. senator and ambassador to China. In his letter, Mr. Baucus, who labored as an adviser to Binance, described Mr. Zhao as a “close to genius” and “probably the most first rate individuals I’ve identified.”

“My impression was that Binance grew exponentially and have become considerably unwieldy,” he wrote. “He now clearly understands he ought to have exercised way more diligence.”

Since his responsible plea, Mr. Zhao has remained in the US, after Decide Jones rejected his request to return residence to his household in Dubai earlier than his sentencing. Prosecutors mentioned within the memo that he had traveled freely all through the nation, together with to Telluride, Colo., and Los Angeles.