Key Factors

Ansys inventory surged 18% on Synopsys acquisition information.

Fellow software program maker Altair, additionally seen as a possible acquisition goal, superior 11.48%.

Analysts predict a 2024 M&A surge, regardless of potential antitrust challenges.

5 shares we like higher than ANSYS

Shareholders of engineering simulation software program maker Ansys Inc. NASDAQ: ANSS obtained a vacation present because the inventory rallied greater than 18% on December 22 on information that Synopsys Inc. NASDAQ: SNPS was in discussions to accumulate the corporate.

Based on a report from Bloomberg and the Wall Road Journal, semiconductor design software program maker Synopsys has provided to purchase Ansys. The businesses haven’t commented publicly on the rumor.

Synopsys, with a market capitalization of $79.71 billion, is a part of the S&P 500, as is the $31.10 billion Ansys. Each expertise shares are tracked within the Expertise Choose Sector SPDR Fund NYSEARCA: XLK.

Why shares of buying corporations fall

Synopsis inventory fell 6.34% on December 22 on information of the acquisition talks. That’s commonplace. Shares of buying corporations typically fall as a result of buyers might fret about overpaying, or whether or not the buying firm could also be stretching its funds too skinny. Buyers additionally don’t like the thought of diluting present shares.

Synopsys shares declined once more on December 26, however simply discovered help at their 50-day transferring common, an indication that the promoting could also be muted from right here on.

Uncertainty concerning the deal’s success and its affect on the acquirer’s future efficiency also can result in a fast worth decline.

Synopsys has been a 2023 success story, although. Shares are up 63.02% this 12 months. You may guess the rationale: The corporate has been growing a set of AI-driven digital design automation. Based on Synopsys, “the first suppliers of this service are semiconductor foundries, or fabs.”

Offering software program for wide selection of industries

Ansys develops engineering simulation software program and companies. In filings, the corporate mentioned its software program is “broadly utilized by engineers, designers, researchers and college students in verticals together with academia, expertise, aerospace and protection, automotive, vitality, industrial tools, supplies and chemical compounds, shopper merchandise, healthcare and building.”A have a look at the Ansys chart exhibits the inventory clearing a five-month consolidation with a purchase level north of $351.23. The inventory added to its beneficial properties on December 26, in heavy buying and selling quantity, uncommon for a vacation week, however with potential acquisition information, buyers come alive.

Small engineering software program maker Altair Engineering Inc. NASDAQ: ALTR moved up in tandem with Ansys, with buyers believing it, too, could also be an acquisition goal.

Initiated protection with “obese” score

Altair Engineering analyst forecasts present JPMorgan Chase initiated protection with a score of “obese” and a worth goal of $86, an upside of 15%.

Altair, Ansys and Synopsys are all tracked inside the identical software program design trade group.

Ansys and Synopsys have a monitor report of collaboration, and are conversant in one another. For instance, in 2017 they partnered to combine the 2 corporations’ applied sciences.

If the cope with Synopsys fails to undergo, analysts say different potential suitors embody Cadence Design Methods Inc. NASDAQ: CDNS, Common Electrical NYSE: GE, Autodesk Inc. NASDAQ: ADSK and Honeywell Worldwide Inc. NASDAQ: HON.

M&A resurgence in 2024?

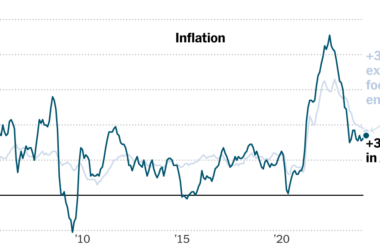

If it appears that evidently buyers are optimistic about upcoming merger and acquisition exercise, there’s good motive: After a drought of offers in 2023, analysts predict a resurgence in 2024.

Based on a November report from S&P International Market Intelligence, “The Large Image: 2024 M&A Business Outlook,” elements set to drive extra M&A embody interest-rate stability, pent-up demand and pushes to consolidate and divest in some industries.

Nonetheless, antitrust regulators within the U.S., who’ve been aggressive in makes an attempt to dam some offers pertaining to techs and pharmaceutical shares, particularly, might proceed to place up roadblocks.

Whereas S&P doesn’t count on 2024 to be a blockbuster 12 months for M&A offers,it says corporations working within the area of AI are prone to be concerned in some transactions.

“A number of subsectors do have the potential to see beneficial properties, together with expertise that provides productiveness and effectivity beneficial properties, together with industrial automation and resolution intelligence platforms,” S&P mentioned. MarketBeat retains monitor of Wall Road’s top-rated and finest performing analysis analysts and the shares they advocate to their purchasers every day. MarketBeat has recognized the 5 shares that prime analysts are quietly whispering to their purchasers to purchase now earlier than the broader market catches on… and ANSYS wasn’t on the listing.Whereas ANSYS presently has a “Maintain” score amongst analysts, top-rated analysts consider these 5 shares are higher buys.View The 5 Shares Right here Click on the hyperlink under and we’ll ship you MarketBeat’s information to investing in electrical automobile applied sciences (EV) and which EV shares present essentially the most promise. Get This Free Report