Key Factors

- Markets remained resilient regardless of a one-two punch from Apple and the roles report.

- Subsequent week, firms like Chipotle and Pepsi will give extra perception into the well being of the patron.

- Listed here are a few of our hottest articles from this week.

- 5 shares we like higher than Apple

Markets remained resilient regardless of the one-two punch it obtained from Apple Inc. NASDAQ: AAPL and the roles report. Apple inventory, a bellwether for the broader market, was down 2% in early buying and selling on Friday after it disclosed softening China gross sales in its quarterly earnings report. And the economic system created considerably extra jobs than anticipated, which, at face worth, places any lingering hopes of a March fee lower to mattress.

Nonetheless, firms have been typically outperforming this earnings season. And within the coming week, buyers will hear from names like Chipotle Mexican Grill Inc. NYSE: CMG, McDonald’s Corp. NYSE: MCD and PepsiCo Inc. NASDAQ: PEP, which is able to present extra knowledge concerning the well being of the patron.

And identical to you’ll be able to depend on the groundhog seeing its shadow or not, the MarketBeat group will keep on high of the shares and tales which can be shifting the market. Listed here are some articles that received essentially the most views on MarketBeat.com this previous week.

Articles by Jea Yu

One of many best methods to put money into synthetic intelligence shares is to take a look at chip shares. This week, Jea Yu highlighted two firms which can be the undisputed market share leaders within the sector and defined why every inventory has extra progress to return.

Buyers additionally proceed to see an upside in journey shares. As Yu factors out, that is significantly true of Marriott Worldwide Inc. NASDAQ: MAR. With the worldwide hospitality trade anticipating a full restoration in 2024, Yu explains why MAR inventory deserves consideration at the same time as the corporate lowered its steering.

Nonetheless, buyers aren’t shaking off the weak steering from Humana Inc. NYSE: HUM. The well being insurer’s inventory is below stress and is elevating questions concerning the rising prices of Medicare Benefit plans.

Articles by Thomas Hughes

One of many largest tales from this earnings season got here from Meta Platforms Inc. (NASDAQ: META). The report dropped on Thursday night time, however Thomas Hughes was scorching on the case with an evaluation of the corporate’s report. With META inventory reaching a important inflection level, you may need to see the place Hughes believes the inventory could possibly be headed.

Hughes additionally wrote concerning the stellar earnings report from Superior Micro Units Inc. NASDAQ: AMD. The corporate lately launched its MI300 chips to compete with Nvidia Company NASDAQ: NVDA. And the early stories present that AMD will be a worthy competitor.

Nonetheless, not all tech shares are getting excessive marks this earnings season. That is the case with Intel Company NASDAQ: INTC. As Hughes writes, the corporate delivered a powerful fourth quarter however is buying and selling decrease after the corporate guided for a weaker-than-expected first quarter.

Articles by Sam Quirke

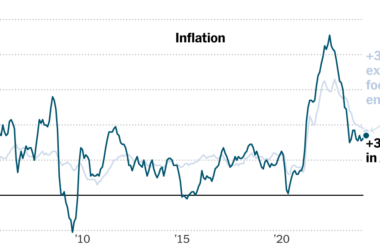

is one other inventory rallying laborious since October 2023. Low cost retailers are likely to do higher when . But, Quirke reminds buyers that DLTR inventory has been doing higher for the reason that fee of inflation has eased. And with , the inventory will not be buying and selling at a reduction for much longer.

Articles by Kate Stalter

Kate Stalter wrote concerning the latest earnings report from Worldwide Enterprise Machines NYSE: IBM and explains why the inventory is buying and selling close to 10-year highs (trace: it is an AI story), and he or she explains why the corporate’s standing as a dividend aristocrat makes this a progress and earnings story.

IBM was additionally one of many shares Stalter wrote about in an article about which can be serving to push the index to new highs. In case you’re a fan of enormous, blue-chip shares, you may need to see how Stalter analyzes the function the Dow shares might have in how these shares are shifting.

Articles by Ryan Hasson

In case you consider in skating the place the puck is shifting, you may search for the sectors the place progress is more likely to be the strongest. In that case, Ryan Hasson presents two solutions. The primary would come from . As Hasson writes, a . But when particular person shares are extra your factor, Hasson analyzes three industrial shares which can be a few of that fund’s largest parts.

Hasson can also be taking a look at homebuilder shares. This sector has been resilient in 2023 and is more likely to have extra upside if the Federal Reserve lowers rates of interest, as anticipated, in some unspecified time in the future in 2024.

And in case you have a extra speculative eye, Hasson explains why the software program firm AppLovin Corp. NYSE: APP is price a more in-depth look. Regardless of the inventory being up 260% within the final 12 months, Hasson explains why larger progress could possibly be forward.

Articles by Gabriel Osorio-Mazilli

The U.S. authorities is about to launch the subsequent tranche of grant cash from the Chips Act. And Gabriel Osorio-Mazilli factors you towards three chip shares which can be seemingly beneficiaries of those grants however are undervalued at their present costs.

And as geopolitical tensions proceed to pop up throughout the globe, significantly within the Center East, it is a good suggestion for buyers to contemplate protection shares. Osorio-Mazilli writes about three protection shares which can be in line to obtain new contracts from the U.S. authorities.

Osorio-Mazilli additionally wrote concerning the latest sell-off in Williams-Sonoma Inc. (NYSE WSM). Whereas drops like this may be upsetting to long-time shareholders, it is necessary to test in case your basic case for proudly owning the inventory continues to be intact. That seems to be the case with WSM inventory, and perhaps that is why Warren Buffett is shopping for the dip.

Articles by MarketBeat Employees

When an organization like Netflix Inc. NASDAQ: NFLX delivers a blowout report, it has ripple results. A kind of ripple results is going on with the share worth of TKO Group Holdings Inc. NYSE: TKO, which is up sharply after its newest take care of the streaming big.

The MarketBeat workers was additionally writing about Celsius Holdings Inc. NASDAQ: CELH. The story right here appears to be that even dangerous information is nice information for this inventory, which continues to garner constructive analyst sentiment even after one notable analyst issued a downgrade.

And in case your responsible pleasure comes within the type of chocolate and different confections or a greasy fast-food burger, you may need to take a look at the workers’s article on two meals shares that simply received upgraded and could possibly be prepared to maneuver larger.

Earlier than you take into account Apple, you may need to hear this.

MarketBeat retains observe of Wall Road’s top-rated and greatest performing analysis analysts and the shares they advocate to their purchasers each day. MarketBeat has recognized the 5 shares that high analysts are quietly whispering to their purchasers to purchase now earlier than the broader market catches on… and Apple wasn’t on the listing.

Whereas Apple presently has a “Reasonable Purchase” score amongst analysts, top-rated analysts consider these 5 shares are higher buys.

View The 5 Shares Right here

Click on the hyperlink under and we’ll ship you MarketBeat’s listing of the ten greatest shares to personal in 2024 and why they need to be in your portfolio.