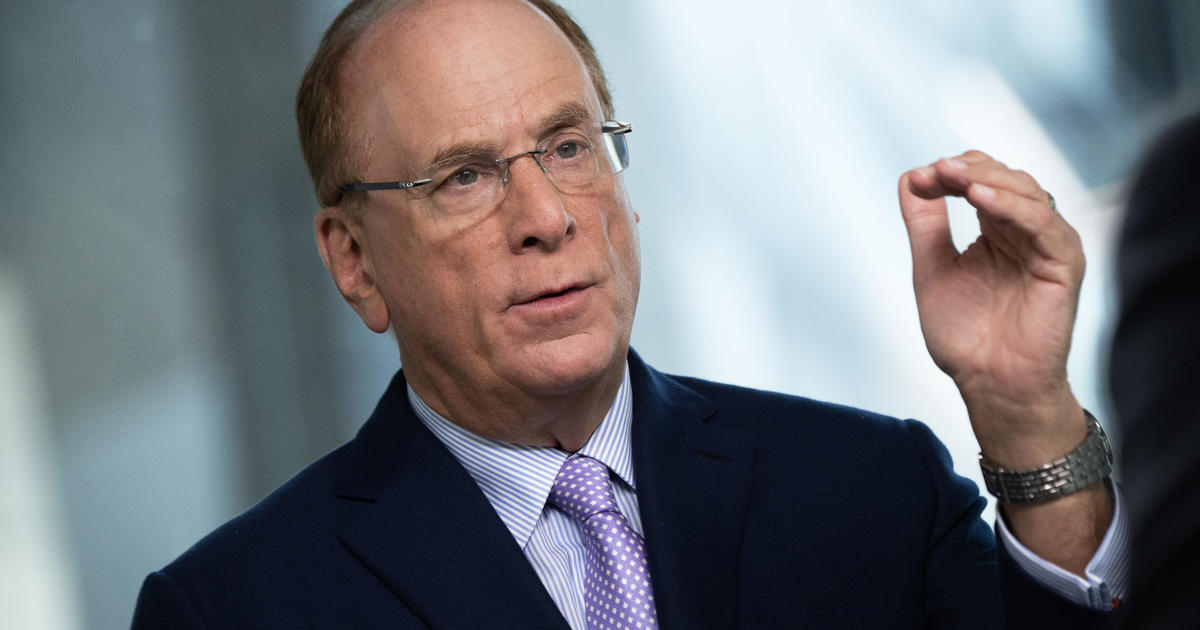

With People residing longer and spending extra years in retirement, the nation’s altering demographics are “placing the U.S. retirement system below immense pressure,” in response to BlackRock CEO Larry Fink in his annual shareholder letter.

One option to repair it, he suggests, is for People to work longer earlier than they head into retirement.

“Nobody ought to need to work longer than they need to. However I do assume it’s kind of loopy that our anchor concept for the appropriate retirement age — 65 years previous — originates from the time of the Ottoman Empire,” Fink wrote in his 2024 letter, which largely focuses on the retirement disaster going through the U.S. and different nations as their populations age.

Fink’s strategies about addressing the nation’s retirement disaster come amid a debate about the way forward for Social Safety, which is able to face a funding shortfall in lower than a decade. Some Republican lawmakers have proposed elevating the retirement age for claiming Social Safety advantages, arguing, like Fink, that as a result of People reside longer, they need to work longer, too.

However that ignores the truth of growing old within the office, with the AARP discovering in a 2022 survey that almost all of staff over 50 say they face ageism at work. And due to ailing well being or an surprising job loss, many older People cease working earlier than they deliberate to. In truth, the median age of retirement within the U.S. is 62 — even decrease than the “conventional” retirement age of 65.

Fink is true in saying that the retirement system is not working for many households, famous retirement professional and New College of Analysis professor Teresa Ghilarducci informed CBS MoneyWatch. However his evaluation that individuals ought to work longer misses the mark, she added.

“After a 40-year-old experiment of a voluntary, do-it-yourself-based pension system, half of staff don’t have any simple option to save for retirement,” she mentioned. “And in wealthy nations, why is not age 65 goal for many staff to cease working for another person?”

She added, “Working longer will not get us out of this. Most individuals do not retire after they need to, anyway.”

Vested curiosity?

To make sure, America’s retirement hole, or the gulf between what individuals must fund their golden years versus what they’ve truly saved, is not new, neither is Social Safety’s looming funding emergency. But Fink’s feedback are noteworthy due to his standing as the pinnacle of the world’s largest asset supervisor, with greater than $10 trillion in belongings, together with many retirement accounts.

After all, Fink has a vested curiosity in People boosting their retirement belongings, provided that his agency collects charges from these accounts. And in his letter, he additionally promotes a brand new target-date fund from BlackRock referred to as LifePath Paycheck, which is able to roll out in April.

“He is steering the dialog towards BlackRock — and lots of people who speak about Social Safety reform on Wall Road need to privatize it in some method and earn cash,” Boston College economist Laurence Kotlikoff, an professional on Social Safety, informed CBS MoneyWatch.

To make sure, Fink additionally praises public coverage success tales for addressing retirement financial savings, akin to Australia’s system, which started within the early Nineties and requires employers to place a portion of a employee’s revenue right into a fund. Right this moment, Australia has the world’s 54th largest inhabitants however the 4th largest retirement system, he famous.

“As a nation, we must always do every little thing we are able to to make retirement investing extra computerized for staff,” he famous.

Can boomers repair the issue?

Fink, who was born in 1952, mentioned that his era has an obligation to assist repair the nation’s retirement issues. The monetary insecurity going through youthful People, akin to millennials and Gen Z, are creating generations of disillusioned, anxious staff, he famous.

“They imagine my era — the infant boomers — have centered on their very own monetary well-being to the detriment of who comes subsequent. And within the case of retirement, they’re proper,” Fink wrote.

He added, “And earlier than my era absolutely disappears from positions of company and political management, we have now an obligation to vary that.”

Boomer (and older) lawmakers and politicians usually do not see eye-to-eye on find out how to repair the retirement disaster. However failing to repair the problem damages not solely the retirements of particular person People, however the nation’s collective perception in the way forward for the U.S., Fink famous.

“We danger changing into a rustic the place individuals preserve their cash below the mattress and their desires bottled up of their bed room,” he famous.