Visa and Mastercard have agreed to cap the so-called swipe charges they cost to retailers that settle for their bank cards, as a part of a class-action settlement that might save retailers an estimated $30 billion over 5 years — the newest improvement in an almost 20-year authorized battle.

Every time a buyer makes use of one in all its bank cards, Visa or Mastercard collects a swipe price — additionally referred to as an interchange price — for processing the transaction, which it shares with banks issuing the playing cards. The retailers cross these charges alongside to clients, a follow that successfully inflates costs (and will inspire reductions given to clients paying with money).

The settlement, which was introduced on Tuesday and is topic to court docket approval, will be traced again to a 2005 lawsuit by retailers arguing that they paid extreme charges to simply accept Visa and Mastercard bank cards.

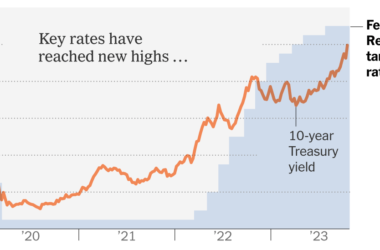

As extra client spending has shifted to bank cards over time, processing charges have additionally risen. To simply accept Visa and Mastercard, U.S. retailers paid $101 billion in whole charges in 2023, together with $72 billion in interchange charges, in accordance with the Nilson Report, which tracks the funds business. The charges additionally generate earnings for giant banks that subject the playing cards, and not directly pay for bank card rewards applications, which aren’t anticipated to be affected by the settlement deal.

Along with placing a ceiling on the swipe charges — a mean of two.26 p.c of the transaction, in accordance with Nilson — Visa and Mastercard agreed to roll again the posted swipe price of each service provider by no less than 0.04 proportion factors for no less than three years. For 5 years, the businesses is not going to elevate the charges above the posted charges on the finish of final 12 months. Systemwide, the typical price have to be no less than 0.07 proportion factors under the present common fee, a calculation that an unbiased auditor will confirm.

Retailers can even be permitted to regulate their costs primarily based on the prices related to accepting completely different playing cards, whereas letting clients know why some playing cards — usually enterprise playing cards and people with extra rewards and perks — value greater than others.

“This settlement achieves our aim of eliminating anticompetitive restraints and offering speedy and significant financial savings to all U.S. retailers, small and enormous,” Robert Eisler, co-lead counsel for the plaintiffs, stated in a press release.

However not all retailers, notably smaller ones, are as optimistic concerning the proposed modifications. Non permanent price reductions fall in need of what’s wanted and underscore why Congress must cross laws to advertise a extra aggressive market, stated the Merchants Payments Coalition, a commerce group representing retailers, supermarkets, comfort shops, gasoline stations and on-line retailers.

“The settlement does nothing to really convey aggressive market forces to swipe charges or change the conduct of a cartel that centrally fixes charges and bars competitors,” stated Christopher Jones, a member of the coalition’s govt committee and senior vice chairman of presidency relations on the Nationwide Grocers Affiliation. “As a substitute, it tries to offer token, momentary reduction after which permits the cardboard firms to lift charges but once more.”

Senator Richard J. Durbin, a Democrat from Illinois who has lengthy fought to maintain interchange charges in verify, introduced bipartisan legislation in June that may require large banks issuing bank cards to allow the playing cards to be processed on no less than one different community moreover Visa or Mastercard, in an effort to create extra choices for retailers past the 2 business heavyweights.

Doug Kantor, basic counsel on the Nationwide Affiliation of Comfort Shops, stated the settlement provisions that may enable retailers to cost extra for bank cards that carried greater charges will likely be difficult to hold out and pitted the retailers in opposition to their clients.

“Even when they do use them, it makes the retailers the tax collector for the costs — and it makes retailers the dangerous man within the eyes of the buyer, when it’s actually the bank card firms which can be squeezing everybody relating to large charges,” Mr. Kantor added.

Neither Visa nor Mastercard admitted to any wrongdoing.

In a press release, Mastercard’s chief authorized officer and basic counsel, Rob Beard, stated the settlement “brings closure to a longstanding dispute by delivering substantial certainty and worth to enterprise homeowners, together with flexibility in how they handle acceptance of card applications.”

Individually, Kim Lawrence, Visa’s president, North America, stated the corporate had “reached a settlement with significant concessions that handle true ache factors small companies have recognized.”

Ron Shevlin, chief analysis officer at Cornerstone Advisors, a financial institution consultancy, stated essentially the most significant a part of the deal could be the flexibility of smaller retailers to band collectively to barter charges as giant teams.

“That is the place the door has opened,” he added, “to one thing they haven’t had the facility to do.”