Key Factors

- Oversold large-cap shares with favorable analyst scores are attracting consideration amidst market shifts, presenting potential shopping for alternatives.

- Lululemon’s inventory is down 23% YTD however beat estimates by $0.29 in its newest earnings report, with analysts predicting 27% potential upside.

- Regardless of Snowflake’s 20% YTD losses, its earnings report surpassed expectations, with analysts foreseeing a 25% potential enhance.

- 5 shares we like higher than NIKE

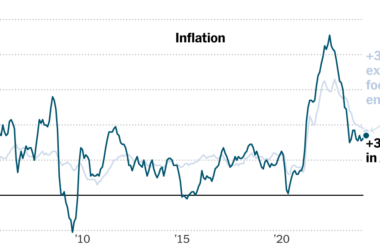

As the primary quarter unfolded, the semiconductor sector’s resounding success has dominated the inventory market narrative, propelling the broader market practically 10% greater. Nevertheless, a notable shift occurred because the quarter drew to an in depth. Defensive sectors like utilities and shopper staples started to realize traction and get away, hinting at a possible redirection of focus in direction of oversold large-cap shares positioned favorably for a rebound.

Amidst this shifting panorama, an thrilling proposition is figuring out extraordinarily oversold shares with favorable analyst scores and predicted upside. Nike, Lululemon, Snowflake, and Adobe have all discovered themselves within the highlight, not for his or her current highs, however for his or her vital pullbacks. Whereas the market has been fixated on the surge of the semiconductor sector and high-flying tech names, these firms have quietly slipped into extremely oversold territory, doubtlessly catching the eye of traders searching for worth amidst volatility.

So, let’s look nearer at these shares to evaluate whether or not they current compelling shopping for alternatives regardless of their present oversold situations or whether or not additional downward stress looms.

Nike, a powerhouse in athletic attire, has endured a difficult 12 months, with shares down practically 14% year-to-date. Nevertheless, its newest earnings report on March twenty first, 2024, provided a ray of hope. Nike beat expectations with earnings per share of $0.98, surpassing estimates by $0.29, and recorded income of $12.43 billion, exceeding forecasts.

Regardless of this 12 months’s weak spot, analysts stay bullish on Nike, projecting practically 25% upside potential. This means confidence in its resilience and progress prospects. The inventory’s RSI of 34.79 signifies it is perhaps extremely oversold and coming into a skewed threat: reward situation to the lengthy facet.

After its newest earnings announcement, the inventory skilled a downward hole and continued to commerce decrease, leading to year-to-date losses nearing 20%. Regardless of this, the cloud-based knowledge storage, laptop, and analytics firm exceeded analysts’ expectations by reporting an EPS of ($0.44), $0.05 greater than the consensus estimate of ($0.49). Moreover, the agency generated $774.70 million in income for the quarter, surpassing analysts’ projections of $759.86 million.

Following weeks of considerable promoting stress, the RSI at the moment stands at 35, indicating considerably oversold situations within the brief time period. Analysts anticipate a substantial upside for the inventory, issuing a reasonable purchase score and setting a value goal suggesting a virtually 25% potential enhance.

Lululemon, a pacesetter in athletic attire, has had a tough begin to the 12 months. Its inventory is down over 23% year-to-date, pushing it into bear market territory. Following its newest earnings report on March twenty first, 2024, the inventory skilled a major downward hole, returning to its 2023 buying and selling vary.

Lululemon reported earnings per share of $5.29 for the quarter, beating estimates by $0.29. Income was $3.21 billion, surpassing expectations and marking a 15.6% year-over-year enhance. Nevertheless, the earnings selloff has left the inventory in extremely oversold territory, with an RSI of 28.

Analysts stay bullish on Lululemon, with a reasonable purchase score based mostly on twenty-nine analyst scores and a consensus value goal indicating virtually 27% potential upside.

Following its current earnings report, Adobe skilled a notable decline, with the inventory gapping decrease to a major degree of earlier assist at $500, a degree final seen in 2023. On March 14th, 2024, Adobe launched its quarterly earnings outcomes, reporting earnings per share (EPS) of $4.48 for the quarter. This surpassed analysts’ consensus estimates by $0.10. Moreover, the corporate generated $5.18 billion in income in the course of the quarter, barely exceeding analyst estimates of $5.14 billion, reflecting an 11.3% year-over-year enhance in quarterly income.

MarketBeat retains observe of Wall Avenue’s top-rated and greatest performing analysis analysts and the shares they advocate to their shoppers each day. MarketBeat has recognized the that high analysts are quietly whispering to their shoppers to purchase now earlier than the broader market catches on… and NIKE wasn’t on the listing.

Whereas NIKE at the moment has a “Average Purchase” score amongst analysts, top-rated analysts consider these 5 shares are higher buys.

View The 5 Shares Right here

Click on the hyperlink beneath and we’ll ship you MarketBeat’s information to pot inventory investing and which pot firms present essentially the most promise.